Renters Insurance in and around Olathe

Get renters insurance in Olathe

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Topeka

Home Is Where Your Heart Is

Your rented property is home. Since that is where you spend time with your loved ones and rest, it can be a wise idea to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your sports equipment, couch, boots, etc., choosing the right coverage can make sure your stuff has protection.

Get renters insurance in Olathe

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

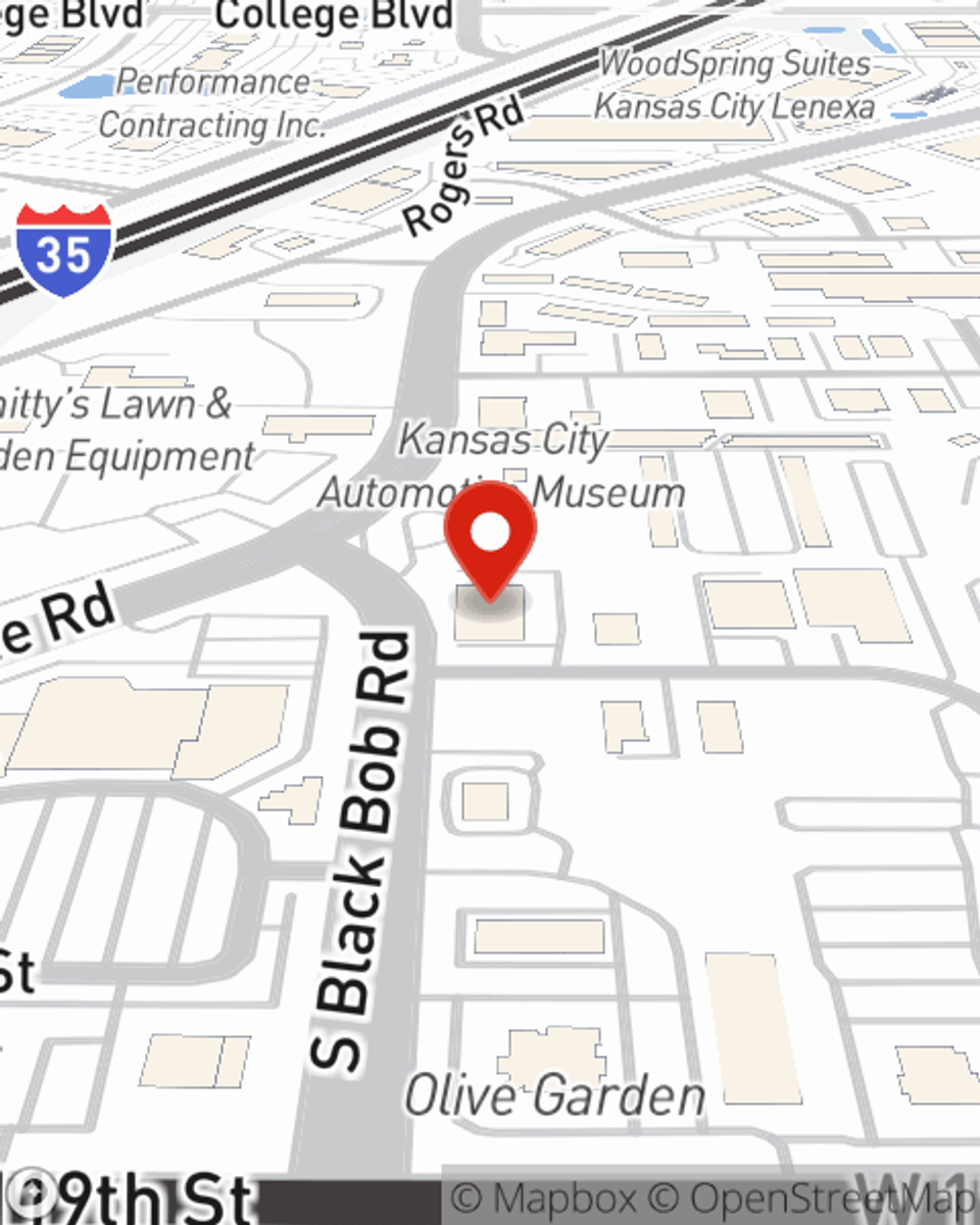

It's likely that your landlord's insurance only covers the structure of the apartment or property you're renting. So, if you want to protect your valuables - such as a video game system, a TV or a bed - renters insurance is what you're looking for. State Farm agent Kevin J Hale is passionate about helping you understand your coverage options and protect yourself from the unexpected.

Don’t let concerns about protecting your personal belongings keep you up at night! Contact State Farm Agent Kevin J Hale today, and learn more about how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Kevin J at (913) 829-4488 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Kevin J Hale

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.